Step-by-Step Guide: How to Receive a Crypto-backed Loan on Biterest

LTV: How does Bitcoin price affect Loan-to-Value ratio?

1 April 2020

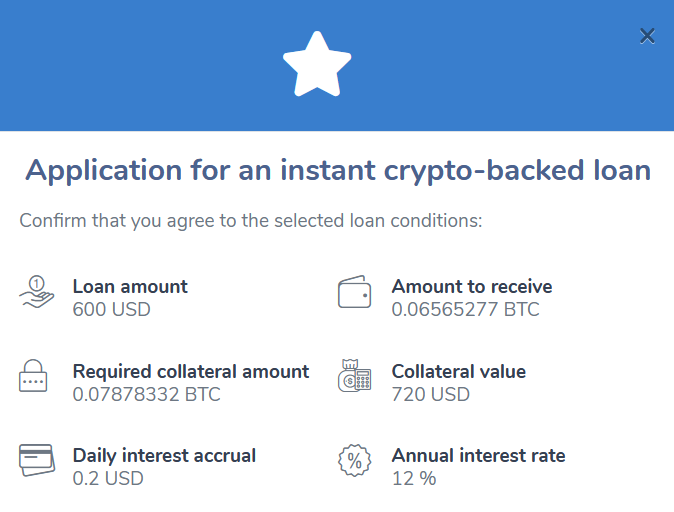

As soon as the loan is issued, you will see the LTV – loan to value ratio of your account. This indicator helps to control the ratio between your used loan limit and the current value of the account balance

Margin Call is under control: How to avoid a forced loan repayment?

24 April 2020

Margin Call is a critical situation in which the borrower’s debt on a loan is forcibly repaid by the user’s collateral because the cost of the collateral at the current bitcoin price does not cover the amount of the used loan limit